The Coronavirus Pandemic has a lot of retirees concerned about their retirement nest egg. In a recent news story, WGRT reported that people on Social Security have no reason to fear a loss of benefits. The recently passed Cares Act provides other provisions that are designed to further help people who have retirement plans.

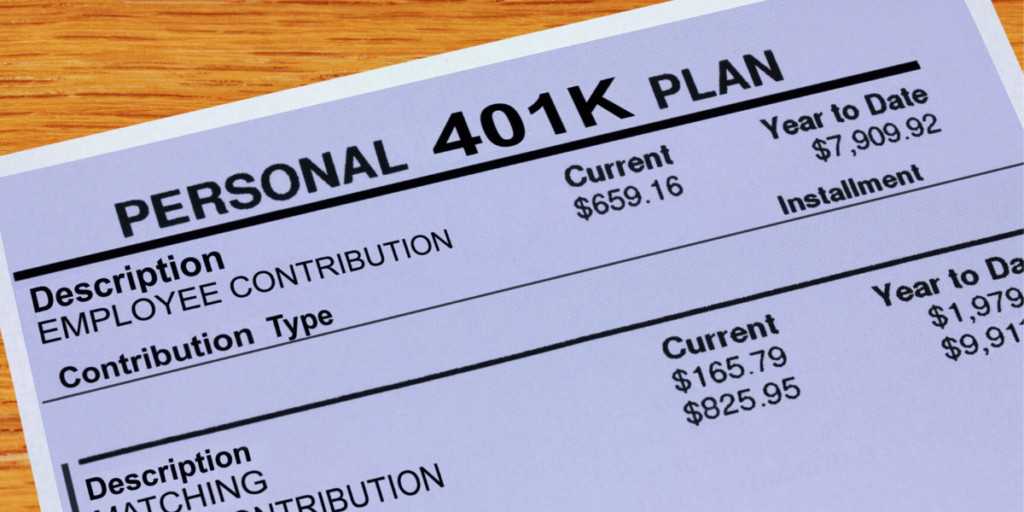

The new law expands the definition of hardship withdrawals from retirement plans, allowing for withdrawals of up to $100,000 and waiving the 10% penalty on hardship withdrawals. The new law also increases loan limits to $100,000 or 100% of a participant’s vested account balance and extends repayment periods for both new and existing loans.

The Cares Act also temporarily waives Required Minimum Distribution rules for 2020, allowing individuals to keep more funds in their retirement plans if they wish. WGRT spoke with Dan Krauskopf, Investment Executive with Beacon Wealth Group in Marysville, and host of the Wise Investor on WGRT. Dan advised people to remember their long term financial plan and not react on emotion. He reminds us that today’s news, headlines, and fears will pass. It is also a great time to consider a Roth conversion.

Reporting for WGRT – Marty Doorn