Career and Technical Education Month Highlights Skilled Trades

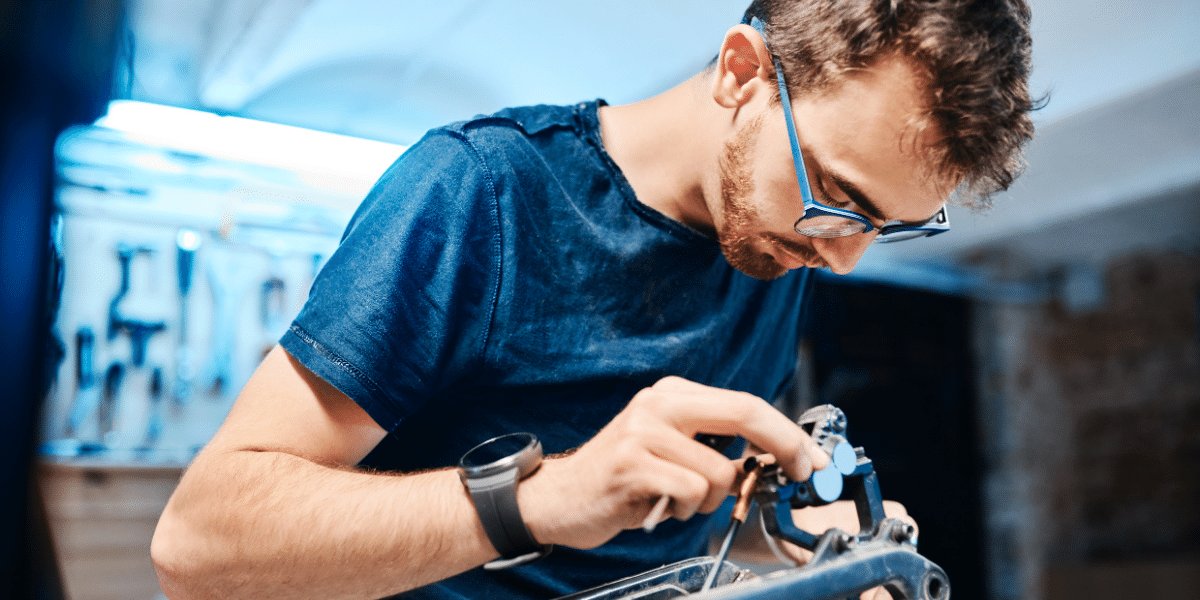

February is Career and Technical Education Month. There are over half a million job openings projected to be available annually for the next seven years. Students are encouraged to explore career pathways that can lead to these high-demand jobs during Career and Technical Education Month.

Career and Technical Education, or CTE programs, are offered in regional “tech centers”, community colleges, and some universities. High demand fields include information technology, health care, hospitality, and manufacturing.

State Superintendent Dr. Michael Rice, said, “Expanding CTE programs in Michigan schools helps to ensure students have the real-world, hands-on experience they need to explore rewarding career opportunities. CTE helps meet one of Michigan’s strategic education plan’s goals to expand secondary learning opportunities for all students – helping to inspire and encourage every student to explore all options along their educational journey.”

There are over 3600 CTE programs in Michigan, with over 97,000 students currently involved. Interested students can explore professional trades careers by visiting Going-PRO.com/CTE.

Reporting for WGRT – Jennie McClelland