Economic assistance for small businesses around Michigan that have been negatively impacted by the COVID-19 virus has gained approval from the Michigan Strategic Fund, the Michigan Economic Development Corporation has announced.

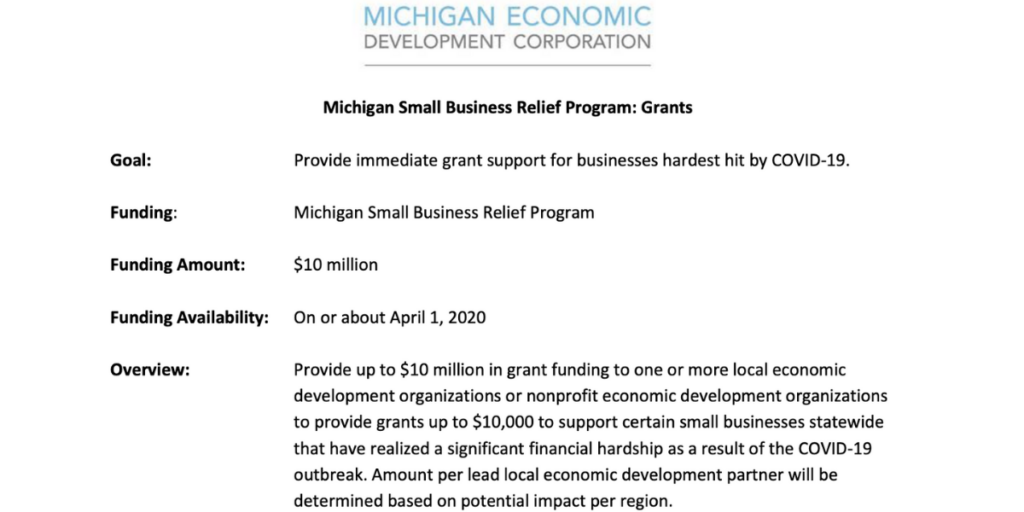

The Michigan Small Business Relief Program authorizes the MEDC to provide up to $20 million in support for small businesses. The funding is divided between $10 million in small business grants and $10 million in small business loans to support businesses facing drastic reductions in cash flow and the continued support of their workforce.

The $10 million in grant funding will be provided to local or nonprofit economic development organizations throughout the state to provide grants up to $10,000 each to support certain small businesses that have realized a significant financial hardship as a result of the COVID-19 virus.

In order to qualify for grant support, businesses must meet criteria including 50 employees or fewer, working capital to support payroll expenses, rent, mortgage payments, utility expenses, or other similar expenses that occur in the ordinary course of business, and the ability to demonstrate an income loss as a result of the EO, or the COVID-19 outbreak.

Additionally, the program will authorize the MEDC to provide up to $10 million for small business loans with flexible repayment terms to support certain small businesses statewide that have realized a significant financial hardship as a result of the COVID-19 outbreak. Loans to eligible borrowers must be $50,000 or more and are capped at $200,000. There are requirements to qualify.

The Michigan Small Business Relief Program will be a top priority for the MEDC, with funds being available no later than April 1, 2020.

For more information and resources for small businesses in Michigan impacted by COVID-19 visit michiganbusiness.org/covid19. The Ecomonic Development Alliance of St. Clair County also has resources on its website at edascc.com